Follow India Renewable Energy News on WhatsApp for exclusive updates on clean energy news and insights

REC Reports 9.4 % Profit Growth in Q2 FY26; Renewable Energy Loans Up 15 %

Oct 27, 2025

Public infrastructure finance company REC Limited reported a net profit of Rs 44.14 billion (~$530.4 million) for the second quarter (Q2) of FY26, marking a 9.4% increase over Rs 40.37 billion (~$484.9 million) recorded in the same period last year. The company’s total revenue rose 12% year-on-year (YoY) to Rs 151.62 billion (~$1.82 billion) from Rs 137.06 billion (~$1.65 billion) in Q2 FY25. REC also declared a second interim dividend of Rs 4.60 per share for the quarter.

As of September 30, 2025, total assets stood at Rs 6.40 trillion (~$76.9 billion), while loan assets reached Rs 5.74 trillion (~$69 billion). The company’s net worth increased to Rs 834.80 billion (~$10.03 billion) from Rs 783.7 billion (~$9.41 billion) a year earlier. REC maintained a debt-equity ratio of 6.02x and a capital-to-risk-weighted-assets ratio (CRAR) of 23.74%, with asset quality showing improvement — gross credit-impaired assets stood at 1.06%, and net credit-impaired assets reduced to 0.24%.

For the first half (H1) of FY26, REC reported a profit of Rs 88.77 billion (~$1.07 billion), up 19% YoY, and total revenue of Rs 299.8 billion (~$3.60 billion), reflecting strong income growth and operational efficiency. The company’s loan book expanded 7% to Rs 5.82 trillion (~$69.94 billion), while total disbursements surged 27% to Rs 1.15 trillion (~$13.82 billion). State-sector loans accounted for 86% of the portfolio, while private-sector exposure stood at 14%.

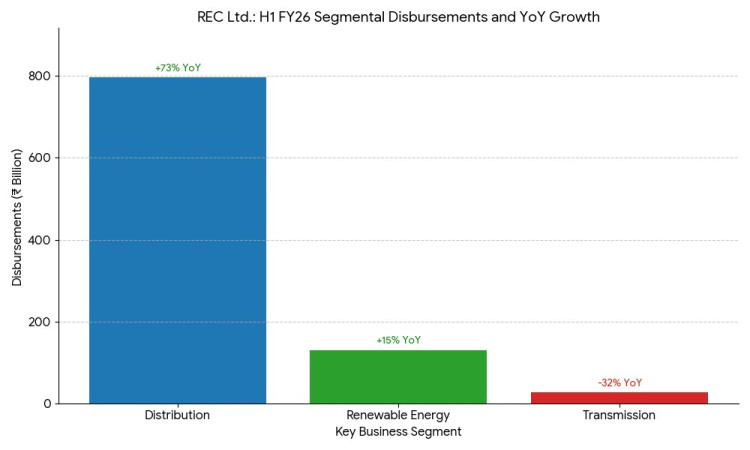

The renewable energy segment remained a key growth driver, with disbursements rising 15% YoY to Rs 130.42 billion (~$1.57 billion) in H1 FY26. The renewable loan book grew 49% to Rs 680.33 billion (~$8.18 billion). REC has financed renewable projects totaling over 61,400 MW, including 26,213 MW of solar, 7,024 MW of wind, 18,310 MW of hydro and pumped storage, 9,242 MW of hybrid systems, and 617 MW from other clean sources.

In the transmission segment, disbursements declined 32% to Rs 26.58 billion (~$319.4 million) due to the completion of several major projects. The segment’s loan assets stood at Rs 440.83 billion (~$5.30 billion), accounting for 8% of the total loan book. REC continues to finance key grid expansion initiatives under the Green Energy Corridor and supports grid integration for over 52 GW of renewable capacity currently under development.

The distribution sector remained REC’s largest business vertical, with loan assets of Rs 2.36 trillion (~$28.37 billion), forming 40% of the total portfolio. Disbursements surged 73% YoY to Rs 797.76 billion (~$9.58 billion), primarily driven by funding for state utilities, smart metering, and grid modernization programs aimed at strengthening financial stability among discoms.

As of September 2025, total borrowings reached Rs 5.07 trillion (~$60.94 billion), up from Rs 4.75 trillion (~$57.09 billion) the previous year. Domestic bonds accounted for 56% of total borrowings, followed by external commercial borrowings at 26% and term loans at 13%. REC’s provision coverage ratio improved to 77.06% from 71.73% in March 2025.

Earlier this year, REC achieved its highest-ever quarterly net profit of Rs 44.51 billion (~$514.09 million) in Q1 FY26, up 29% YoY, supported by a 21% revenue increase to Rs 153.48 billion (~$1.79 billion). The company’s consistent growth underscores its expanding role in financing India’s clean energy and infrastructure transformation.