Follow India Renewable Energy News on WhatsApp for exclusive updates on clean energy news and insights

Virtual PPAs Set to Redefine India’s Renewable Energy Market

Oct 27, 2025

CERC Nears Final Guidelines for Virtual Power Purchase Agreements, Marking a Major Policy Shift in Clean Energy Procurement

India’s renewable energy sector is approaching a transformative milestone as the Central Electricity Regulatory Commission (CERC) finalises a comprehensive regulatory framework for Virtual Power Purchase Agreements (VPPAs) — a move expected to boost corporate participation and accelerate green energy deployment across the country.

The initiative follows extensive stakeholder consultations, which saw over 60 responses from global corporations such as Google and Accenture, leading Indian renewable developers like ACME and ReNew Power, as well as think tanks, energy exchanges, and the Solar Energy Corporation of India (SECI).

Once operational, the VPPA framework will offer revenue certainty to renewable energy developers while enabling corporates to procure green attributes without entering traditional physical power purchase agreements (PPAs).

Bridging the Financing Gap for Merchant Projects

India’s merchant renewable energy projects — those operating without long-term offtake agreements — have long faced financing challenges due to fluctuating market prices. The introduction of VPPAs could help mitigate these risks by guaranteeing developers a minimum strike price, ensuring predictable revenue streams even without direct power sales.

Rohit Bajaj, Joint Managing Director of the Indian Energy Exchange (IEX), remarked that VPPAs are “poised to enhance merchant power capacity in India by enabling corporates to meet sustainability goals while developers gain price stability.”

Understanding How Virtual PPAs Work

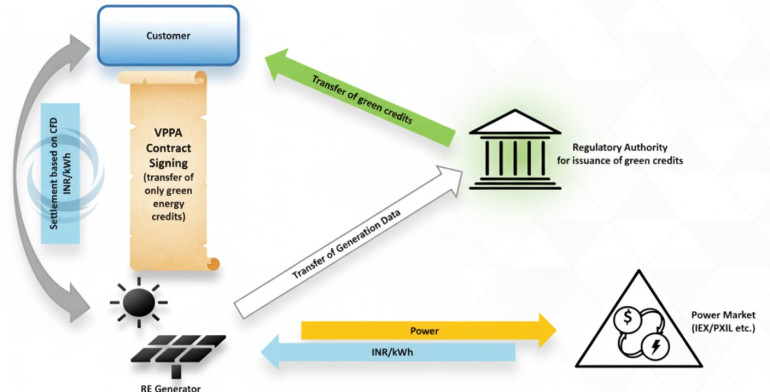

A Virtual Power Purchase Agreement (VPPA) is a financial contract between a renewable energy generator (for instance, ReNew Power) and a corporate buyer (such as Google). Instead of physically transferring electricity, both parties agree on a fixed strike price for the power.

- If the market price exceeds the strike price, the developer compensates the corporate buyer.

- If the market price falls below the strike price, the corporate buyer pays the difference to the developer.

In exchange, the corporate buyer receives Renewable Energy Certificates (RECs) or Energy Attribute Certificates (EACs), which count toward their sustainability and ESG goals. This model allows companies to decarbonise operations financially, without handling physical power delivery or signing rigid long-term PPAs.

Industry Push for Broader Participation

While CERC’s draft currently limits VPPA eligibility to firms acquiring RECs, multiple global stakeholders have recommended expanding the framework to include corporates seeking ESG-linked Energy Attribute Certificates (EACs). According to Accenture, this move could unlock significant international investment and speed up renewable capacity growth.

Google also supported this broader approach, suggesting that VPPAs should encompass all recognised environmental attributes, not just RECs. Similarly, the US–India Strategic Partnership Forum cautioned that restricting VPPA participation to complianc